Sickness Daily Allowance Insurance in Germany

– Insurance –

Maintain your full income during a mid-long disease

– Insurance –

Maintain your full income during a mid-long disease

The Sickness Daily Allowance Insurance is Germany’s answer to the problem that not every disease or broken bone is healed after 6 weeks. Why is that important? Because your employer only has to pay your salary for 6 more weeks in case you get sick or had an accident.

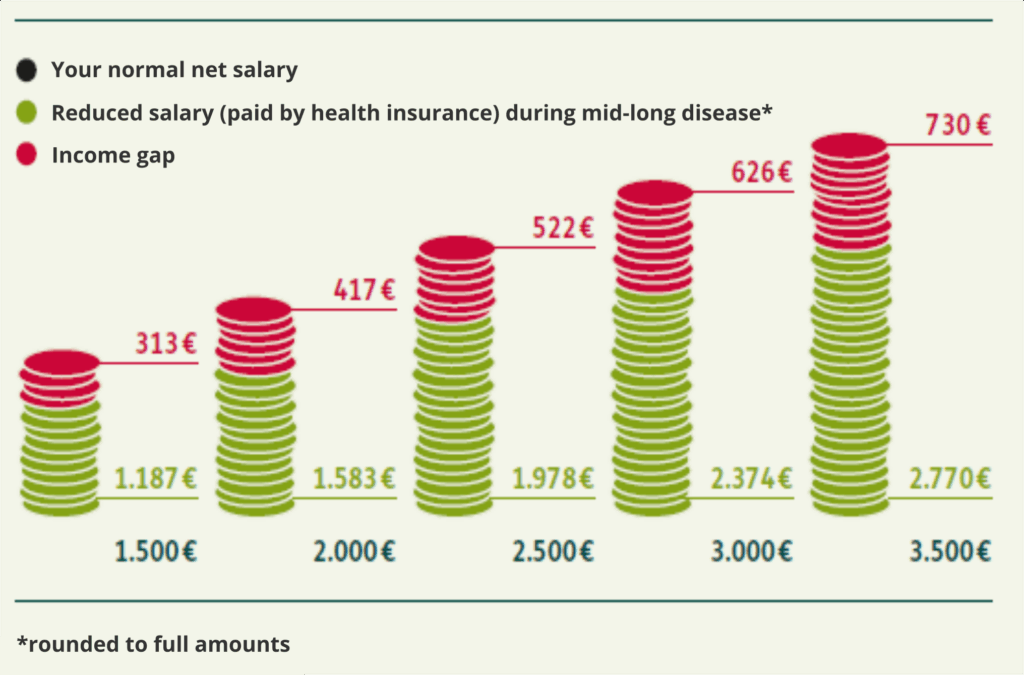

So the average flu is covered by your boss, but how about a broken shoulder, a minor burn-out or cancer they discovered early? If you need to stay home for anything between 6 weeks and 1,5 years, your health insurance will pay roundabout 70 % of your former gross income. That leads to a seizable income gap, and this gap is covered by the Sickness Daily Allowance Insurance.

The Sickness Daily Allowance Insurance is offered by private insurance companies. It pays an agreed upon amount in case you as the insured person can’t work for anything between 6 and 72 weeks due to a disease or an accident.The total sum per month is broken down into equal sums per day, giving this insurance its name.

If you are still unable to work after 72 weeks, the Occupational Disability Insurance kicks in (if you have one).

To determine the premium, the insurance company mainly focuses on 5 factors: The amount needed, when coverage should start (e. g. it could start after 4 days, after 2 weeks or after months), your age when applying, your job and your health status. Since payout phase is limited to a max of 72 weeks, a Sickness Daily Allowance Insurance is usually cheaper (and easier to get) than an Occuptional Disability Insurance.

The Sickness Daily Allowance Insurance is only sold via private insurance companies, and just like the Occupational Disability Insurance, it doesn’t have to be granted. When applying, you will have to answer health related questions.

Since the process can be complicated for non-experts and the risk of handing out too little (or too much) personal information is high, we strongly recommend asking a licenced insurance advisor to handle your application.

If one (or more) insurance companies didn’t accept you as a client, you can go for a Basic Ability Insurance instead. Those insurances cover your basic abilities such as being able to see, hear, move, talk, write etc. They do not cover diseases as such, but do cover a loss of a basic ability as a result of a disease. Since coverage is limited in comparison to an Occupational Disability Insurance, a Basic Ability Insurance is usually cheaper and easier to get.

It might even be possible to get a Sickness Daily Allowance Insurance via your employer. Please contact us for further details.

Absolutely. You can apply for a Sickness Daily Allowance Insurance in Germany as soon as you have a legal address in Germany (= Anmeldung) and Germany is your main location of living (= Hauptwohnsitz). With most insurance companies, coverage is worldwide, meaning you’re also covered if e.g. you have an accident abroad that leads to a mid-long absence from work.

Of course. A Sickness Daily Allowance Insurance can be canceled for any reason and at any time. Cancellation period is usually between 1 and 3 months, though differences may occur. Once the contract is canceled, you would have to go through the application process again if you wanted coverage at any time in the future.

We will take a look at your personal risks & budget and match your needs with the right insurance

We will help you with the application and do all the paperwork for you

We will make sure you understand every detail of the insurance contract

We will be your link between the insurance company and yourself – now and in the future

¹By clicking on this button you accept our Terms & Conditions

*Insurances like Sickness Daily Allowance Insurance in Germany are run by insurance companies that usually sell their products with the help of licensed advisors. Our team members are licensed. When it comes to pensions and insurances, we collaborate with ERGO Lebensversicherung AG. This means the consultation is free of charge and done by one of our licensed insurance advisors, and a commission is paid to us when setting up a pension or insurance.

Hello! My name is Verena Metzler. I am a Business Financial Expert and Consultant, holding licenses in personal pension, insurance and investment advice. I am both legally allowed and educationally equipped to help women become financially independent and build the future they wish for.

True independence needs financial independence. This is why Yvonne Bäldle-Agboton, a certified and very driven Career Coach, and I founded FrauFUTURE. Women of all ages and origins, women with smaller and bigger dreams, women with debts or without, women in life crisis and those on top of their career have come to our office. What they all have in common: the desire to take their financial future into their own hands.

Don’t rely on luck. Rely on yourself.