Occupational Disability Insurance in Germany

– Insurance –

Protect your income and your living standard from any future blows of fate

– Insurance –

Protect your income and your living standard from any future blows of fate

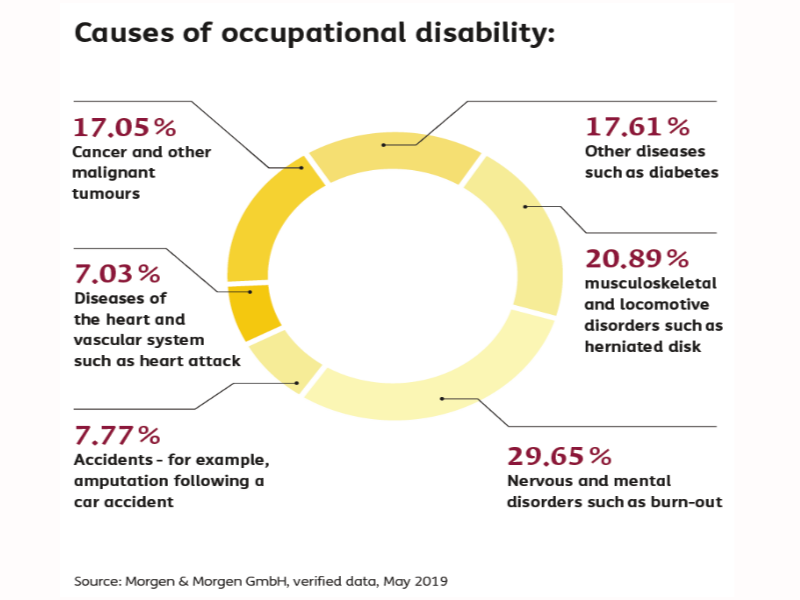

The Occupational Disability Insurance is a must-have for everyone living in Germany. Whether it’s a long-term disease like cancer or a bad form of diabetes, an accident that led to permanent damage, mental disorders such as burn-out or depression, or a chronically bad back: The reasons why people lose their ability to work for the foreseeable future are manifold.

And it hits 1 out of 4.

In this case, the statutory support of Germany is limited. In 2023, the average monthly payout in case of an occupational disability was 1.059 €. In the same year, the poverty line in Germany was at 1.310 €. Considering monthly costs like rent and food, additional coverage from private insurance should be mandatory. This is called Occupational Disability Insurance.

The Occupational Disability Insurance is an insurance offered by private insurance companies. It pays an agreed upon amount in case you as the insured person lose your ability to work for the foreseeable future and by at least 50 %. In general, coverage starts after 1,5 years, as your health insurance usually pays a reduced salary until that point.

The premium depends mainly on 4 factors: Your age when applying, your profession, the amount you want paid out (plus optional extras), and your health status until that point. Because those 4 factors vary with every person, an individual offer is necessary.

The Occupational Disability Insurance is only sold via private insurance companies. It doesn’t have to be granted. When applying, you will have to answer health related questions. Additionally, most insurance companies will ask to be allowed to contact your doctor for further information. Since the process can be complicated for non-experts and the risk of handing out too little (or too much) personal information is high, we strongly recommend asking a licenced insurance advisor to handle your application.

If one (or more) insurance companies didn’t accept you as a client, you can go for a Basic Ability Insurance instead. Those insurances cover your basic abilities such as being able to see, hear, move, talk, write etc. They do not cover diseases as such, but do cover a loss of a basic ability as a result of a disease. Since coverage is limited in comparison to an Occupational Disability Insurance, a Basic Ability Insurance is usually cheaper and easier to get.

Alternatively, you can also try to apply for an Occupational Disability Insurance via your employer. For more information on this option, please contact us.

Yes. You can apply for an Occupational Disability Insurance in Germany as soon as you have a legal address in Germany (= Anmeldung) and Germany is your main location of living (= Hauptwohnsitz). With most insurance companies, coverage is worldwide, meaning you’re also covered if e.g. you have an accident abroad that leads to occupational disability.

Yes. An Occupational Disability Insurance can be canceled for any reason and at any time. Cancellation period is usually between 1 and 3 months, though differences may occur. Once the contract is canceled, you would have to go through the application process again if you wanted coverage at any time in the future.

We will take a look at your personal risks & budget and match your needs with the right insurance

We will help you with the application and do all the paperwork for you

We will make sure you understand every detail of the insurance contract

We will be your link between the insurance company and yourself – now and in the future

¹By clicking on this button you accept our Terms & Conditions

*Insurances like Occupational Disability Insurance in Germany are run by insurance companies that usually sell their products with the help of licensed advisors. Our team members are licensed. When it comes to pensions and insurances, we collaborate with ERGO Lebensversicherung AG. This means the consultation is free of charge and done by one of our licensed insurance advisors, and a commission is paid to us when setting up a pension or insurance.

Hello! My name is Verena Metzler. I am a Business Financial Expert and Consultant, holding licenses in personal pension, insurance and investment advice. I am both legally allowed and educationally equipped to help women become financially independent and build the future they wish for.

True independence needs financial independence. This is why Yvonne Bäldle-Agboton, a certified and very driven Career Coach, and I founded FrauFUTURE. Women of all ages and origins, women with smaller and bigger dreams, women with debts or without, women in life crisis and those on top of their career have come to our office. What they all have in common: the desire to take their financial future into their own hands.

Don’t rely on luck. Rely on yourself.