Company pension for employers in Germany

– Pension –

Increase the loyality of your employees by showing them you care

– Pension –

Increase the loyality of your employees by showing them you care

With Germany’s statutory pension being less than half of your average net income, additional pension plans become more important every day.

A company pension plan is a great way to …

… take the stress out of retirement for your employees

… increase team loyality

… stand out in your industry and improve your employer brand

… have skilled labor come work for you instead of your competitor

But it needs to be done right. As licensed advisors, FrauFUTURE supports you every step of the way, making sure you get a company pension plan tailored to your needs with as little work for HR and payroll as possible.

Want an informative, fun, and interactive workshop to introduce your pension plan to your team?

There are five different company pension schemes in germany, the most common one being called Entgeltumwandlung (= transformation of salary). An Entgeltumwandlung allows the employee to pay an agreed-upon amount of their salary into an additional pension plan, that is NOT the statutory pension. The amount is paid from the salary of the employee, but because it is deducted from the gross salary, the employer makes sure the contriubtion is deducted correctly.

The company pension offers the highest benefit for employees of all pension plans in Germany. This is due to two facts:

!. The contribution to the company pension is deducted from the gross salary. Therefore, the gross salary gets reduced. Now, tax on wage and social securities get deducted based on the reduced gross salary, leading to a decreased contribution to both. Because of this dynamic, the loss in net salary is ~ 50 % of the actual contribution to the company pension. For example, if an employee contributes 100 € from their gross salary to a company pension, the net salary goes down by only 50 €.

2. Due to the decreased gross salary, the personell costs for the employer go down by ~ 20 %. Of this, the employee get’s three quarters on top of their own contribution. For example, if the employee contributes 100 €, the employer tops it up by another 15 €. So the employee has a company pension worth 115 € every month, but the loss in net income is only 50 €.

The company pension offers multiple benefits for employers:

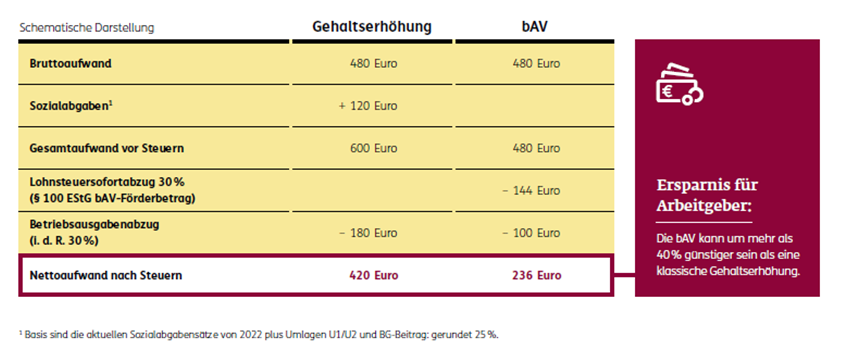

a) Employers have to top up their employees’ contribution by 15 %, but their reduction in personell costs is usually 20 %. The other 5 % can be kept, making the company pension plan a great way to do something for your employees while simultaniously reducing costs.

b) Employers don’t have to keep the other 5 %, but they can also give it to their employees, increasing the top-up to 20 %. Higher contributions are also possible. The employer can even contribute 100 %. Those top-ups are tax-deductible, no matter the amount! This gives you as the employer the option to improve team loyality and market yourself as a modern and social employer brand, with Germany paying part of the bill.

c) Employers can offer a company pension instead of a salary raise. The employee will benefit from an extra pension that grows over time, and the employer will benefit from lower costs.

With company pensions in the form of an Entgeltumwandlung, the employer is the official signatory of the contract. The employee is the beneficiary. Once an employee leaves the company, they have the right to take their plan with them and either contribute on their own or take the plan to their next employer.

If their previous employer had paid more than the required 15 % top-up, the employee needs to have worked at their old company for a specific amount of years for that money to be legally theirs.

Yes and no. You do have to respect the equality principle, meaning among peers, you have to offer every employee the same plan and top-up. But you are allowed to separate by career level, offering e.g. a higher top-up to your managers and a different plan to everyone else.

Not really. Company pensions can be canceled, but not by you, but only by the employee. That being said, you are allowed to cancel any additional top-ups you might have granted in the beginning.

We will take a look at your company’s needs & budget and match your requirements with the right plan

We will talk to all your employees individually and do all the paperwork for you

We will make sure you and your employees understand every detail of the pension plan

We will be your link between the insurance company, you and your employees – now and in the future

¹By clicking on this button you accept our Terms & Conditions

*Company pension plans are run by insurance companies that usually sell their products with the help of licensed advisors. Our team members are licensed. When it comes to pensions and insurances, we collaborate with ERGO Lebensversicherung AG. This means the consultation is free of charge and done by one of our licensed insurance advisors, and a commission is paid to us when setting up a pension or insurance.

Hello! My name is Verena Metzler. I am a Business Financial Expert and Consultant, holding licenses in personal pension, insurance and investment advice. My team and I are both legally allowed and educationally equipped to implement a company pension at companies of any size and legal status.

Keeping moral high and skilled labor in the company can be so easy! Let’s have a talk.